July 29, 2025

Beyond Transactions: How Synovus is Creating Deeper Digital Engagement at Scale

By Jody Bhagat, President Global Banking, Personetics

When Synovus Bank, named one of Newsweek’s Most Trustworthy Companies, set out to reshape their client experience, they focused on one clear goal: creating deeper digital engagement at scale. During a webinar hosted by the Consumer Bankers Association, Lee Sessions, Chief Consumer Product and Solutions Officer, shared how this $60B regional powerhouse is redefining what personalized banking means for their customers.

The Power of Engagement

Synovus strategy is built on a clear understanding of what engagement means for their business. “We know engaged clients have higher relationship balances, have higher satisfaction scores, rate us higher on advice, and essentially we believe it’s the gateway to primacy.” Sessions explained.

A Coordinated Approach to Personalization

What sets Synovus’ approach apart is their comprehensive view of customer engagement. “When logging into the mobile app, I want to be alerted on how to manage my finances better. If I’m going to the branch and talking to a banker or on the phone to an advisor, however, I expect them to be equipped with the same level of guidance.” Sessions noted. This extends to every customer touchpoint, creating a consistent and coordinated experience.

Three Pillars of Success

The bank established three major requirements for their evolution:

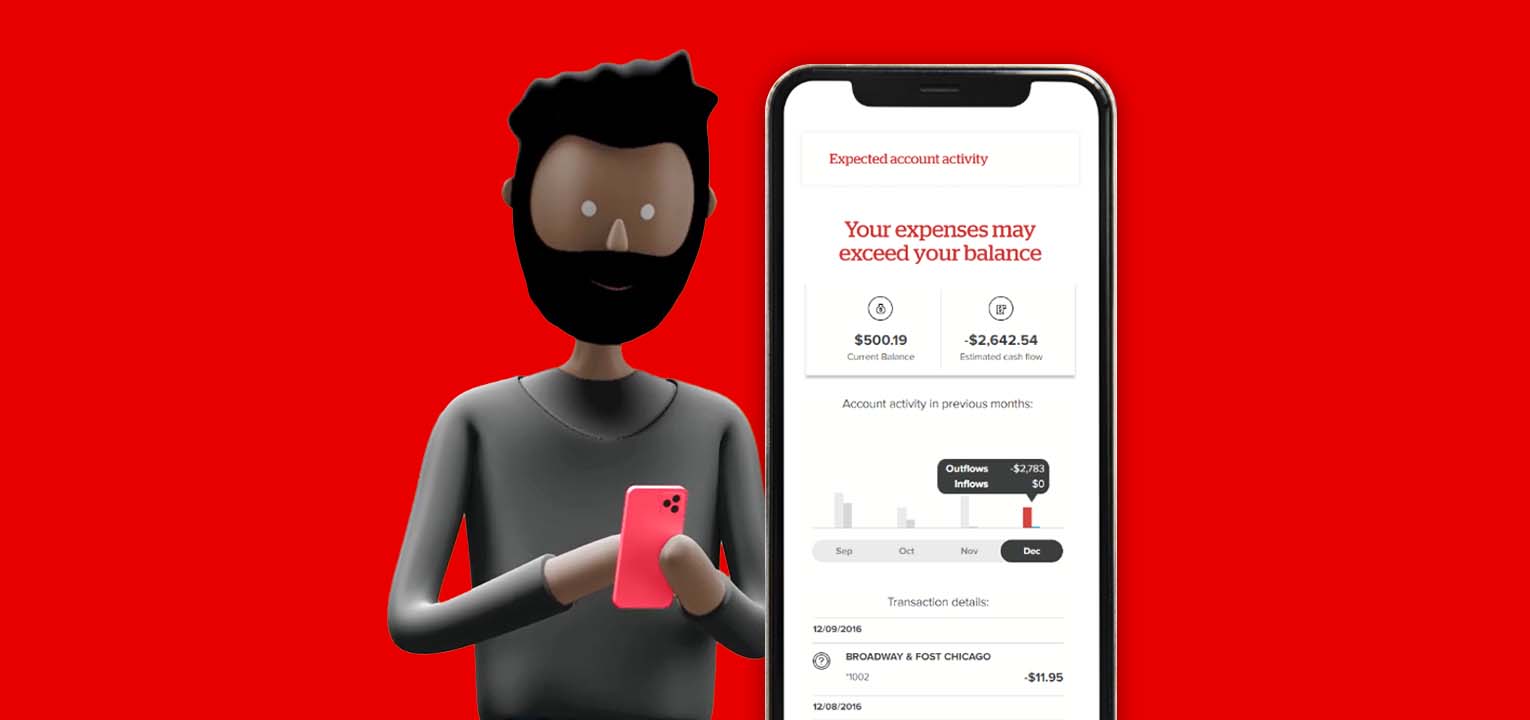

First, they wanted the experience to be relational rather than transactional. “Historically speaking, you’d log into the mobile app and you could transfer money, you could pay a bill, you could see your balances. But we wanted to change that and really create it more like an advisory experience.” Sessions explained.

Second, they focused on making digital banking emotional. Sessions emphasized how different customers respond to different approaches: “Some customers we know like a witty tone. Others might like a more serious tone. Some customers might want a graphic image. Others might like a lifestyle image.” For Synovus, making digital banking emotional isn’t just about user interface; it’s about creating genuine connections. “By very nature, we’re all emotional,” Sessions noted. “Personalization makes customers feel valued and understood; that leads to more engaging and satisfying experiences when you’re creating the connection with them.”

Third, they committed to making the experience truly personal through data-driven financial insights unique to each customer’s situation and financial goals.

Measuring Success

The results of this initiative have been compelling. Synovus has created over 60 custom insights that achieve a 20% engagement rate and maintain a 4.3 out of 5-star average rating. Most importantly, engaged customers exhibit a 10-point increase in customer satisfaction for financial guidance, along with larger relationship balances. For a deeper analysis of Synovus’ success, read the case study.

Looking Forward

The bank’s vision for the future centers on what Sessions calls “high tech meets high touch”; providing coordinated experiences across all channels, whether digital, in-branch, or marketing. This approach moves beyond the traditional boundaries where digital channels were purely transactional, branch interactions were advisory, and marketing was promotional.

Their success demonstrates that regional banks can deliver highly personalized experiences while maintaining efficiency and scale. By focusing on emotional connections, consistent experiences across channels, and data-driven insights, Synovus is creating a new model for modern banking.

As the banking industry continues to evolve, Synovus’ approach offers valuable lessons in how institutions can enhance their digital experiences while maintaining the personal touch that customers value.

To learn how you can achieve 20%+ engagement rates like Synovus and significantly increase customer satisfaction, schedule a conversation with our team.

Want To See How Cognitive Banking and AI Can Transform Customer Engagement?

Request a Demo Now

Latest Posts

How to Monetize AI While Building Trust

Cognitive Banking, Primacy, and the New AI Playbook for Banks: Insights from Money 20/20

How to Prevent Churn & Grow Wallet Share: Bank Primacy Playbook

How to Maximize SaaS Value and Future-Proof Your Platform

Truist's Performance Marketing Journey: From Merger Challenges to Million-Dollar Results

How Asia Pacific Banks Are Redefining AI-Driven Engagement

Jody Bhagat

President Global Banking

Jody brings deep operating experience in financial services – managing direct channels, launching digital ventures, and leading digital transformation programs. He was previously a Partner at McKinsey & Company, where he helped financial institutions define and execute digital transformation programs to drive customer growth and operating efficiency. Jody also served in senior digital operating roles at U.S. Bank, Wells Fargo, and Providian. In these positions, he led digital sales and service functions and direct to consumer businesses to deliver organic growth and enhanced customer experience. Jody has an MBA from Northwestern University and a BS in Computer Engineering from The University of Michigan.