July 3, 2025

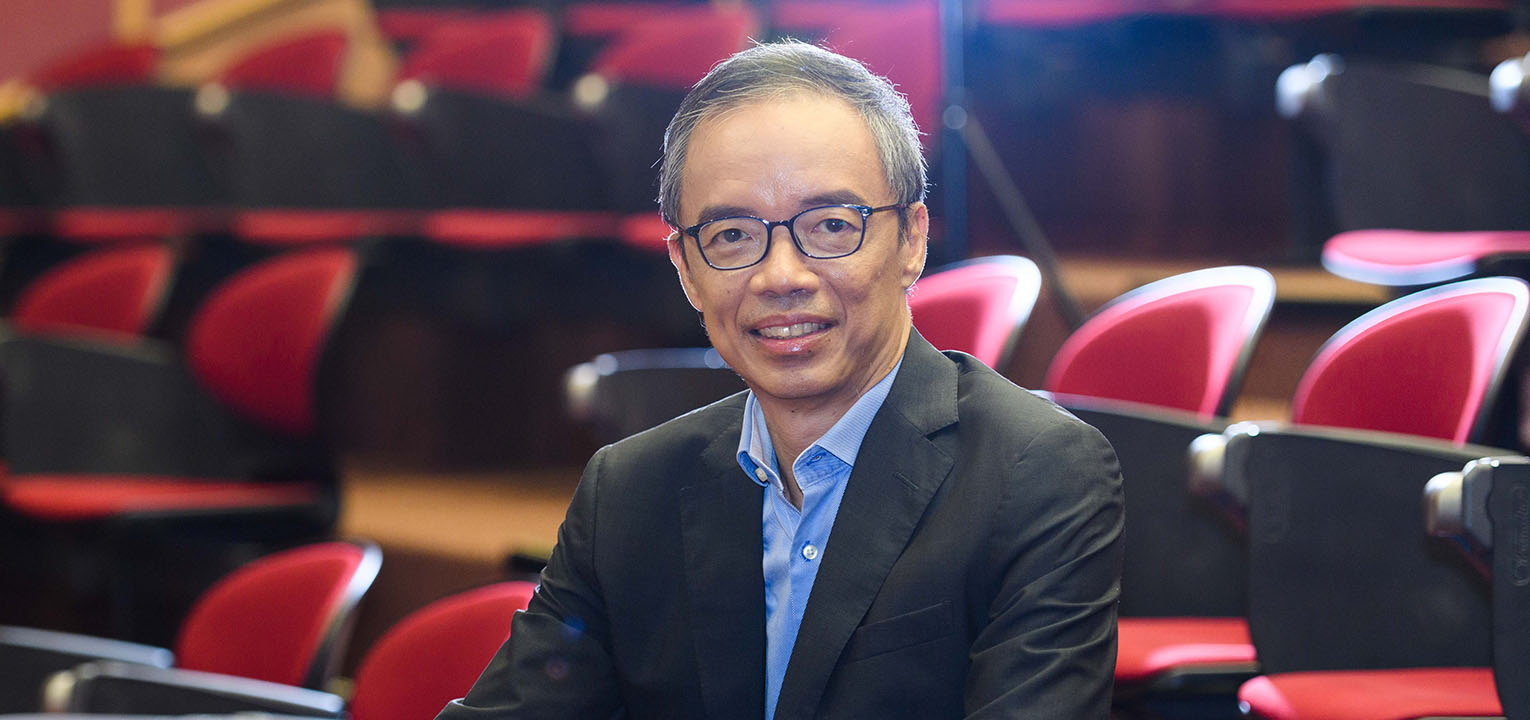

Why Asia Pacific Banks Must Lean into Cognitive Banking: A Conversation with Dr. Dennis Khoo

By Jody Bhagat, President Global Banking, Personetics

Asia Pacific is fast becoming a global epicenter for banking innovation. And few voices are more authoritative on the region’s transformation than Dr. Dennis Khoo. A seasoned digital executive, bestselling author, and visionary leader based in Singapore, Dennis is Managing Partner at allDigital Future. Previously, he served as Group Head of UOB’s TMRW Digital Bank and led Consumer Banking at Standard Chartered. On our recent Banking on Innovation podcast, I had the pleasure of talking to Dennis, who shared deep insights on what sets leading banks apart in this fast-moving landscape. His core message? In Asia Pacific’s crowded, high-expectation market, success hinges not only on making banking easier, but also on making it smarter. And that starts with stellar execution and purposeful engagement, two pillars that align seamlessly with the principles of Cognitive Banking.

A Region Ripe for Digital Reinvention

Despite certain global perceptions, Southeast Asia’s banking sector is a dynamic, competitive space. Markets like Singapore, Thailand, and Malaysia are already among the world’s leaders in digital financial services, while others – Indonesia, Vietnam, and the Philippines – are catching up fast. “This is by no means a sleepy industry,” Dennis says. “When one of the big players does something new, the others quickly respond to keep pace.” And with regulators supporting innovation and customers expecting seamless experiences, banks in the region are under pressure to accelerate their digital journeys. But this is just the beginning; the region’s real transformation is still to come.

Watch the full podcast episode

Challenger Banks are Quite the Challenge

In a competitive, sophisticated market like Asia Pacific, where high standards and customer focus are par for the course, challenger banks face steep odds. “There’s a reason they’re called challenger banks,” Dennis says. “You can’t bring up half a bank. You’ve got to go for the full set.” When launching UOB’s TMRW in 2017, Dennis rejected the conventional playbook and built from scratch. After extensive research and reimagining the customer journey, his team identified three essential layers of differentiation:

- Do the basics brilliantly. From onboarding to payments and credit, core banking services must be seamless and intuitive.

- Deliver a standout launch experience. Customers won’t switch unless there’s clear, immediate value.

- Use data proactively. Don’t just respond to problems; anticipate and prevent them.

Beyond Digital: It’s All About Execution

For Dennis, true digital transformation is not just about slick interfaces or novel features. It’s about disciplined execution that drives measurable customer outcomes.

Case in point: At TMRW, Dennis was tasked with doubling or even tripling the bank’s Net Promoter Score (NPS) – a major challenge in leading Asia Pacific markets, where baseline scores hover around a relatively high 50. “In Thailand, striving for 75 or 80 is a big challenge,” he says. “And to do that, you’ve got to get the entire experience right.” What makes it hard? In banking, good ideas don’t stay exclusive for long – big, legacy players can quickly replicate standout features. Moreover, achieving scale demands a significant upfront investment that takes time before delivering profits.

The Next Battlefield: Cognitive Banking

So how can banks truly differentiate when everyone eventually gets the basics right, especially when the sector is based on a core activity—the transfer of money—making it difficult to stand out?

Reflecting the approach he used when establishing TMRW, Dennis says we should envision banking as a pyramid. At the base is great, flawless transactional banking. Above that is responsive, efficient customer service. And at the pinnacle is predictive engagement – using data to understand and serve customers before they even ask for help. “It’s just a matter of time that everyone gets the basics better,” Dennis says. “The real battlefield is shifting to the two upper layers.” And that’s where Cognitive Banking, which is about understanding customers in context and engaging them intelligently, comes in.

Start with Engagement, Not Personalization

Many banks approach Cognitive Banking by jumping straight into personalization. But Dennis believes they’re getting it backwards. “Cognitive Banking is a weapon for engagement,” he says. “You must engage before you can personalize.” Unlike e-commerce, where product preferences are relatively straightforward, banking relationships are complex and ever-evolving. That’s why simply relying on transactional data, which is often broad rather than deep, isn’t enough. To really understand customers, banks must engage in a dialog – ask questions, test ideas, and learn from feedback. Engagement fuels insight, and insight makes personalization truly meaningful.

Start From the Top

Cognitive Banking isn’t just about deploying AI or analytics. It’s a mindset and an operating model, and it starts at the top of the banking hierarchy. “Banking is a service,” Dennis points out. “If leadership doesn’t prioritize understanding the customer, all you’re left with is more products and more fees.” But when leaders put the customer first, everything else falls into place. The formula? Make banking easier. Get closer to the customer. And focus on the countless small improvements that, when stitched together, create a truly differentiated experience.

To win the next generation of customers, Asia Pacific’s banks must become more than digital, according to Dennis. They must become Cognitive and excel in execution. But being Cognitive isn’t just about having the data. It’s about knowing how to use it to truly serve the needs of customers. The banks that embrace the shift to Cognitive Banking will be the ones to create breakthrough experiences for thriving in the future.

Watch the full podcast episode

=============================================================

Dr. Dennis Khoo has authored two books offering practical guidance for leaders navigating digital transformation. Driving Digital Transformation draws on his experience building ASEAN’s first digital bank, emphasizing customer focus, data, and Agile strategy. His second book, A Holistic Approach to Transformation and Innovation in a Complex World, introduces the allDigitalFuture Playbook (taP), a framework that blends systems thinking with design and Agile methods to drive innovation.

See: https://www.alldigitalfuture.com/

How can you listen to the podcast?

Please tune in and join me and my guests on this journey.

You can access new Banking on Innovation podcast episodes here: Spotify, Apple, and YouTube.

Connect with podcast host Jody Bhagat on LinkedIn: https://www.linkedin.com/in/digitalbusinessgrower

Want To See How Cognitive Banking and AI Can Transform Customer Engagement?

Request a Demo Now

Related Posts

How Personalized Engagement Drives Business Impact for Banks Across Southeast Asia

Going Big in Japan

Meheriar Hasan, Chairman of BRAC Bank: Know Your Customers to Understand Their Needs

How Open Banking Will Drive Business Impact Across APAC

Redefining Financial Engagement in Australia with Open Banking

Jody Bhagat

President Global Banking

Jody brings deep operating experience in financial services – managing direct channels, launching digital ventures, and leading digital transformation programs. He was previously a Partner at McKinsey & Company, where he helped financial institutions define and execute digital transformation programs to drive customer growth and operating efficiency. Jody also served in senior digital operating roles at U.S. Bank, Wells Fargo, and Providian. In these positions, he led digital sales and service functions and direct to consumer businesses to deliver organic growth and enhanced customer experience. Jody has an MBA from Northwestern University and a BS in Computer Engineering from The University of Michigan.